As a mom I invest a ton of time, energy and money into all three of my kids. From son up till son down, they come first. I often give up things or forget to do things for myself all together!

But, while being hyper focused on my children and their future, I have totally forgotten about mine. I have no plan for my retirement years- and it’s scary to think about it. This time of year I’m often focusing on what to get for the kids. Winter clothes, Christmas presents, and so on. But this year I’m taking a couple minutes for myself to visit AceYourRetirement.org for personalized, simple tips to make sure I’m on track with my retirement savings.

Taking steps to take control of your retirement planning could have a positive impact in many areas of your life. According to a recent survey from AARP and the Ad Council, more than half of people in their 40s and 50s say that feeling more confident about saving for retirement would help them feel less stressed (54%). And 46% would be happier knowing they are taking care of their family’s future. I know I feel better after chatting with Avo at AceYourRetirement.org.

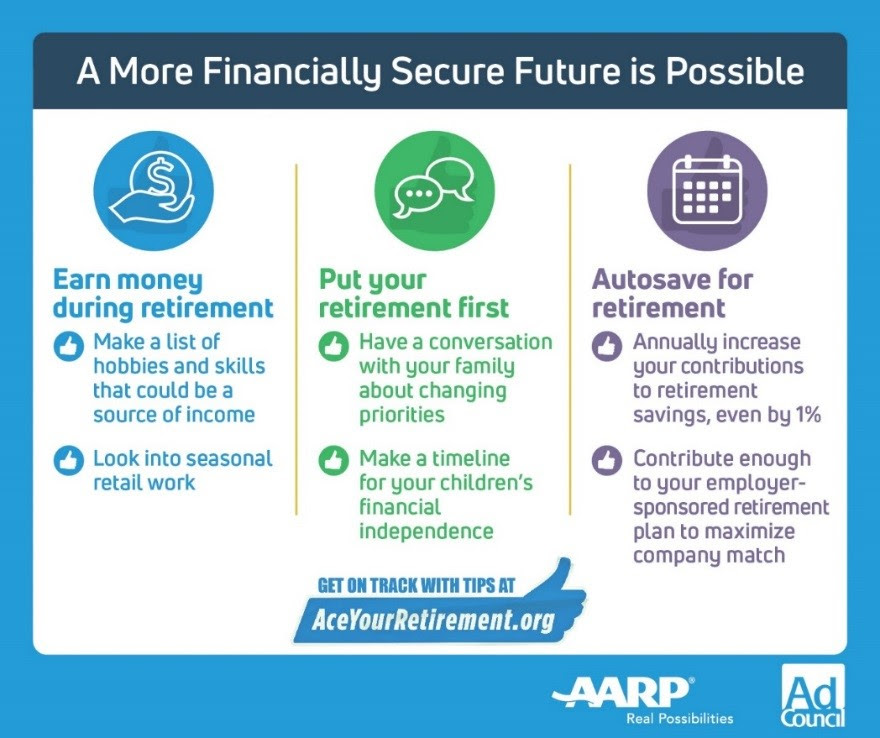

Here are a few tips to consider to help you maximize your retirement savings:

- While gathered with your family for the holidays, discuss your savings plans and long-term retirement goals, and what you can do today to achieve them. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

- If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match.

- Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, or taking on seasonal part-time work.

Are you saving for your retirement yet?

Speak Your Mind